Forex trading can be an exciting yet challenging endeavor. For traders, understanding the intricacies of the forex market is crucial to achieving success. In this article, we will delve into a comprehensive example of forex trading, illustrating various strategies and practices. We will also recommend reliable resources like forex trading example Trading Broker UZ to enhance your trading experience.

What is Forex Trading?

Forex, or foreign exchange, involves trading currencies on a global decentralized market. It’s one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. Traders buy and sell currency pairs, speculating on the fluctuations in their exchange rates. This trading can be influenced by various factors, including economic indicators, geopolitical events, and market sentiment.

Understanding Currency Pairs

In forex trading, currencies are always traded in pairs, such as EUR/USD or USD/JPY. The first currency in the pair is the base currency, while the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD pair is quoted at 1.2000, it means 1 Euro can be exchanged for 1.20 US Dollars.

Choosing a Trading Strategy

Selecting a trading strategy is pivotal for success in forex trading. Different strategies suit different trading styles and market scenarios. Here are a few common strategies:

- Day Trading: Involves making multiple trades within a single day, capitalizing on small price movements.

- Swing Trading: Traders hold positions for several days or weeks to profit from expected price shifts.

- Scalping: A rapid trading strategy where traders aim to make small profits from numerous trades throughout the day.

- Position Trading: Long-term strategy where traders hold onto positions for months or even years based on fundamental analysis.

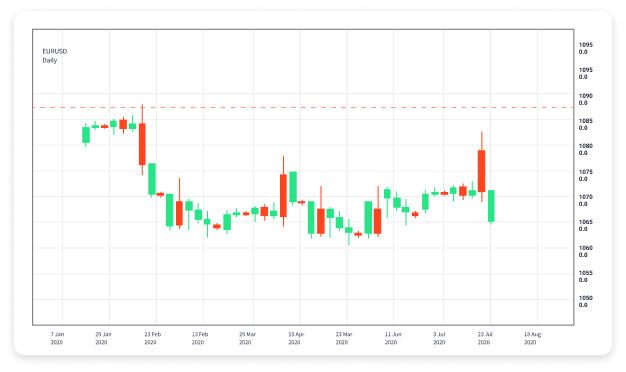

Example Scenario: Day Trading the EUR/USD Pair

To illustrate a day trading example, let’s assume a trader decides to focus on the EUR/USD currency pair. They begin their day by examining the market and conducting technical analysis, identifying key support and resistance levels on the price chart.

Step 1: Market Analysis

The trader notices that the EUR/USD pair has hit a resistance level at 1.2100 and has previously bounced back from this level. They decide to sell (short) the pair if the price reaches this point again and shows signs of weakness. To make informed decisions, the trader also considers economic news releases impacting the Euro and the US Dollar, such as employment data or GDP growth rates.

Step 2: Setting Up Trades

The trader places a sell order at 1.2100 with a stop-loss set at 1.2120 to safeguard against unexpected price movements. They also set a take-profit target at 1.2050, aiming to lock in profits as the price moves in their favor.

Step 3: Executing the Plan

As the market opens, the EUR/USD price rises to 1.2100, triggering the trader’s sell order. The trader monitors the price closely, observing fluctuations and market sentiment throughout the day. The price eventually retraces, and at 1.2050, the take-profit order is executed, closing the trade with a profit.

Risk Management Practices

Effective risk management is essential in forex trading. Here are some practices to consider:

- Use Stop-Loss Orders: Always set stop-loss orders to limit potential losses.

- Position Sizing: Determine the appropriate position size based on your trading capital and risk tolerance.

- Diversification: Avoid putting all funds into a single trade or currency pair. Diversifying reduces the overall risk.

- Emotional Discipline: Stick to your trading plan, avoiding impulsive decisions or emotional trading.

Learning and Continuous Improvement

Forex trading is a continuous learning process. Traders should constantly seek to improve their skills through education, practice, and analysis of past trades. Utilizing demo trading accounts can provide valuable practice without risking real capital. Additionally, consider participating in forums and following market analysts to stay updated with the latest trends and insights.

Conclusion

Forex trading offers significant opportunities, but it requires thorough understanding and preparation. By following the structured approach discussed in this article and implementing effective risk management practices, traders can navigate the market successfully. Resources such as Trading Broker UZ can support traders in their journey by providing valuable tools and assistance. Remember, the key to success lies in education, discipline, and a well-thought-out trading strategy.