If the company is not considered to be a going concern (meaning the company will not be able to continue in business), it must be disclosed, and liquidation values become the relevant amounts. We begin with brief descriptions of many of the underlying principles, assumptions, concepts, constraints, qualitative characteristics, etc. As the formula indicates, assets go on the left side of the equation and are debited. For example, if you receive cash, your accounting software would debit your cash account behind the scenes. Business accounting software makes it easy to record every small transaction, since most products automatically sync with your business checking accounts and business credit cards. Under the conservatism concept, revenue and expenses are treated differently.

Frequently Asked Questions About GAAP

This concept relates to the significance of an item in the financial statements. An item is considered material if its omission or misstatement could influence the decisions of users. Material items must be disclosed appropriately in the financial statements. When a company has been consistent with its methods and principles, I can easily 5 principles of accounting pick up its financial statements (FS) and I can deduce which year the company performed better. This is just a tip of what you can enjoy when you have a consistent company financial statement. In the case of rules-based methods like GAAP, complex rules can cause unnecessary complications in the preparation of financial statements.

Why You Can Trust Finance Strategists

It appears to be a good reference guide for someone to learn about how accounting is used in the business world. For a beginner’s guide, the depth of knowledge is outstanding in this text. For example, quality management is a topic that can be found repeatedly in this text. Explanations for how the content can be used to improve business processes are beneficial to learning. The text also explains how all stakeholders in the business can benefit from accounting knowledge. The accrual basis of accounting recognizes revenues and expenses in the period incurred, regardless of when cash is received or paid.

You’re our first priority.Every time.

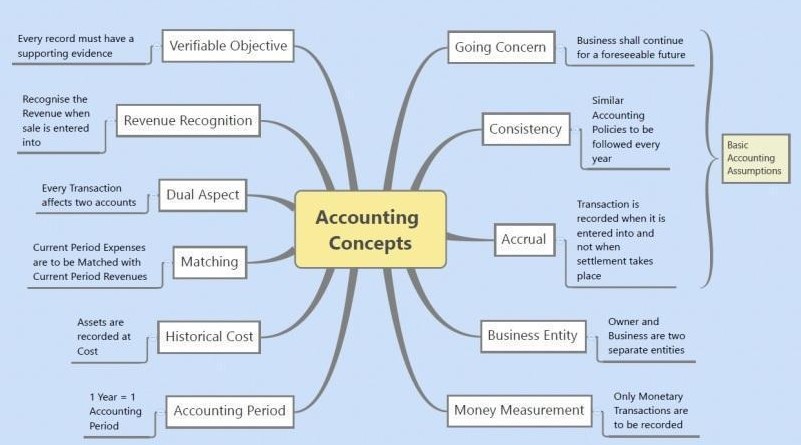

This makes it easier for investors to analyze and extract useful information from the company’s financial statements, including trend data over a period of time. It also facilitates the comparison of financial information across different companies. Overall, understanding accounting principles before implementing accounting processes in a business is important. It will help keep a smooth track of the finances and maintain transparency of financial events. Even if you are a novice accountant, make sure to have clear ideas of the types and characteristics of accounting principles to avoid errors in financial recordings and produce accurate results.

What is the Purpose of Accounting Principles?

- The organization of the text is similar to most accounting textbooks I have used in the past, except for there is an omission of partnerships as a separate topic.

- This concept advises accountants to exercise caution when making estimates and to recognize potential losses and expenses rather than potential gains.

- If the revenues come from a secondary activity, they are considered to be nonoperating revenues.

- It treats the firm as a separate accounting entity, limiting the mixing of personal and corporate assets and liabilities and improving financial transparency.

- We must maintain and instill compliance among the student learners of today.

Even if this results in minor transactions being recorded, the idea is that it’s better to give a comprehensive look at the business — this is especially important in the event of an audit. Materiality Concept – anything that would change a financial statement user’s mind or decision about the company should be recorded or noted in the financial statements. If a business event occurred that is so insignificant that an investor or creditor wouldn’t care about it, the event need not be recorded. The book has a detailed chapter of contents and an index with an alphabetized glossary.

The board comprises seven full-time, impartial members, ensuring that it works for the public's best interest. The FAF is responsible for appointing board members and ensuring that these boards operate fairly and transparently. Members of the public can attend FAF organization meetings in person or through live webcasts. According to accounting historian Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants.

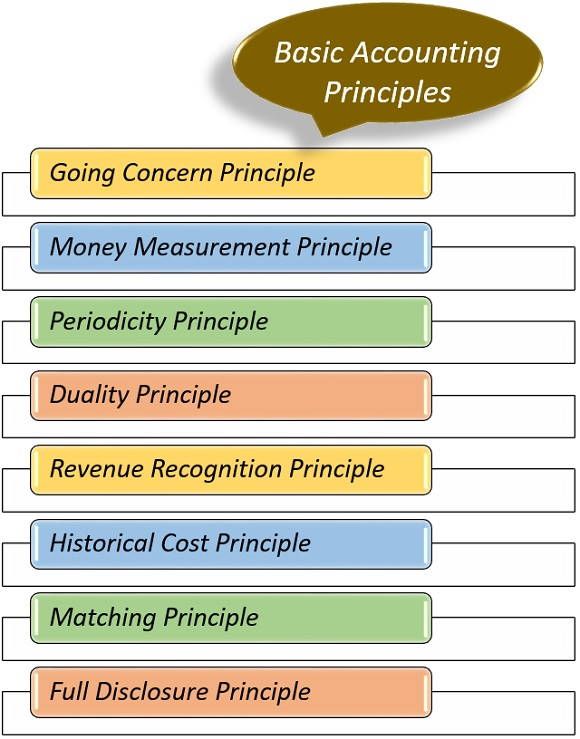

By following GAAP guidelines, compliant organizations ensure the accuracy, consistency, and transparency of their financial disclosures. Accounting principles are a set of rules and guidelines that govern the process of financial reporting. These principles ensure that financial information is recorded, classified, and presented in a consistent and accurate manner. By adhering to these principles, businesses can provide stakeholders with reliable and transparent financial statements.

This is especially critical when providing information regarding managerial accounting, which is a cumulative learning process. Although there is some terminology that is used that is not exact, it is much less the case than other textbooks I have used and reviewed. Adherence to these rules ensures that accounting records are maintained on more or less the same basis by all business units and can, therefore, be relied upon and used for comparison. This principle helps stakeholders make informed decisions by ensuring that all relevant information is disclosed. “Intermediate Accounting” by Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield.